not featured

2025-05-30

5/30/2025

published

%20(50).jpg)

How Autobooks and QuickBooks Compare for Small Businesses

Whether it's building the next tech empire or simply making a good living, small business owners share one thing in common: they're passionate and determined to succeed at what they love. But unless you're an accountant, the day-to-day grind of managing invoices, payments, and keeping your books balanced can feel overwhelming.

The good news is you don't have to be an accountant to master your business finances. Powerful accounting software like Autobooks and QuickBooks can streamline your operations and free up your time. While we've previously explored the benefits of Autobooks, it's worth comparing it head-to-head with another popular option: QuickBooks. In this post, we'll break down the key differences between these two platforms to help you choose the best tool for growing your business.

What is Autobooks?

Autobooks make managing your small business finances easy. Integrated seamlessly with your CS Bank account, it simplifies essential tasks like small business invoicing, accepting payments, tracking expenses, and generating reports.

Key Features

- Invoicing: Create professional-looking invoices with your business logo, track their status, and automate payment reminders.

- Online Payments: Accept various payment methods, including credit cards, debit cards, and ACH bank transfers, directly through your invoices.

- Expense Tracking: Categorize and track your business expenses to get a clear picture of where your money is going.

- Financial Reporting: Generate essential reports like profit and loss statements and balance sheets to understand your business's financial health.

- Bank Reconciliation: Reconcile your bank transactions with your Autobooks records, ensuring accuracy and saving you time.

- Basic Accounting: Provides standard accounting functions like general ledger, accounts payable, and accounts receivable.

What is QuickBooks?

Serving the needs of small to medium-sized businesses, QuickBooks offers a wide range of tools to manage business finances effectively. QuickBooks integrates with various third-party apps and services, allowing business owners to connect with other business tools.

Key Features

- Core Accounting: Handles all the fundamental tasks, including managing income and expenses, creating invoices, tracking sales and purchases, and generating financial reports like profit and loss statements and balance sheets.

- Invoicing and Payments: Create professional-looking invoices, track their status, accept online payments, and automate payment reminders to improve cash flow.

- Expense Tracking: Categorize and monitor expenses, giving you insights into where your money is going.

- Bank Reconciliation: Match your bank transactions with your QuickBooks records to ensure accuracy and identify any discrepancies.

- Inventory Management: Track inventory levels, costs, and sales, helping you manage stock effectively.

- Payroll: Manage payroll, calculate taxes, and pay employees.

- Reporting: Generate a wide range of reports to gain insights into your business's financial performance, including sales reports, expense reports, and tax reports.

- Industry-Specific Versions: Offers tailored versions with specialized features for industries like construction, manufacturing, retail, and non-profits.

| Feature | Autobooks | Quickbooks |

|---|---|---|

| Integration with banking | Often integrated | Usually separate |

| Interface | Simpler, user-friendly | More complex, feature-rich |

| Automation | More automated features | Some automation available |

| Cost | Generally lower | Higher, with tiered plans |

| Features | Focus on essentials | Wider range of features |

| Scalability | Limited scalability | More scalable |

| Support | Growing community | Large user base and extensive support |

Common Ground in Autobooks and QuickBooks

Autobooks and QuickBooks share some fundamental similarities that make them valuable tools for small businesses.

Autobooks and QuickBooks share some fundamental similarities that make them valuable tools for small businesses.

Core Accounting Functions: Both platforms provide the essential account features that small businesses need, like invoicing, expense tracking, bank reconciliation, and financial reporting.

User-Friendly Interface: Both strive to offer an easy-to-use interface, with slight differences. Autobooks prioritizes simplicity with a clean design and standard features, while QuickBooks provides a more comprehensive interface with a broader range of functionalities.

Cloud-Based Accessibility: Both are cloud-based solutions, meaning you can access your financial data from anywhere with internet access or via its mobile app, offering flexibility and convenience.

Automate Key Tasks: Both platforms automate certain tasks to save time and reduce errors, such as automated invoice creation and sending, payment reminders, and bank reconciliation.

Autobooks integrates directly with your online and mobile banking so you don't need a separate tool.

Differences in Autobooks and QuickBooks

While Autobooks and QuickBooks share some common ground, there are key differences to consider when choosing the right accounting software for your business.

Integration with Banking: Autobooks relies on deep integration with the bank's systems to provide streamlined functionality, especially for features like direct payments and automatic reconciliation. QuickBooks is a standalone application that requires a separate login and manual data import.

Features: Autobooks focuses on standard features like invoicing, payments, and expense tracking with a simpler interface, while QuickBooks offers a wider range of features, including inventory management, payroll, and advanced reporting, but with a potentially steeper learning curve.

Scalability: Autobooks is more suitable for micro or small businesses with basic accounting needs and limited growth plans. QuickBooks offers varying levels of functionality, making it more scalable for growing businesses.

Pricing: Autobooks is generally more affordable, while QuickBooks can be more expensive, with tiered pricing plans based on features and users.

User Experience: Autobooks has a clean and intuitive interface that is easy to use. QuickBooks offers more advanced features, which makes the user experience more complex, catering to users with varying levels of accounting knowledge.

Which is Right for Your Small Business?

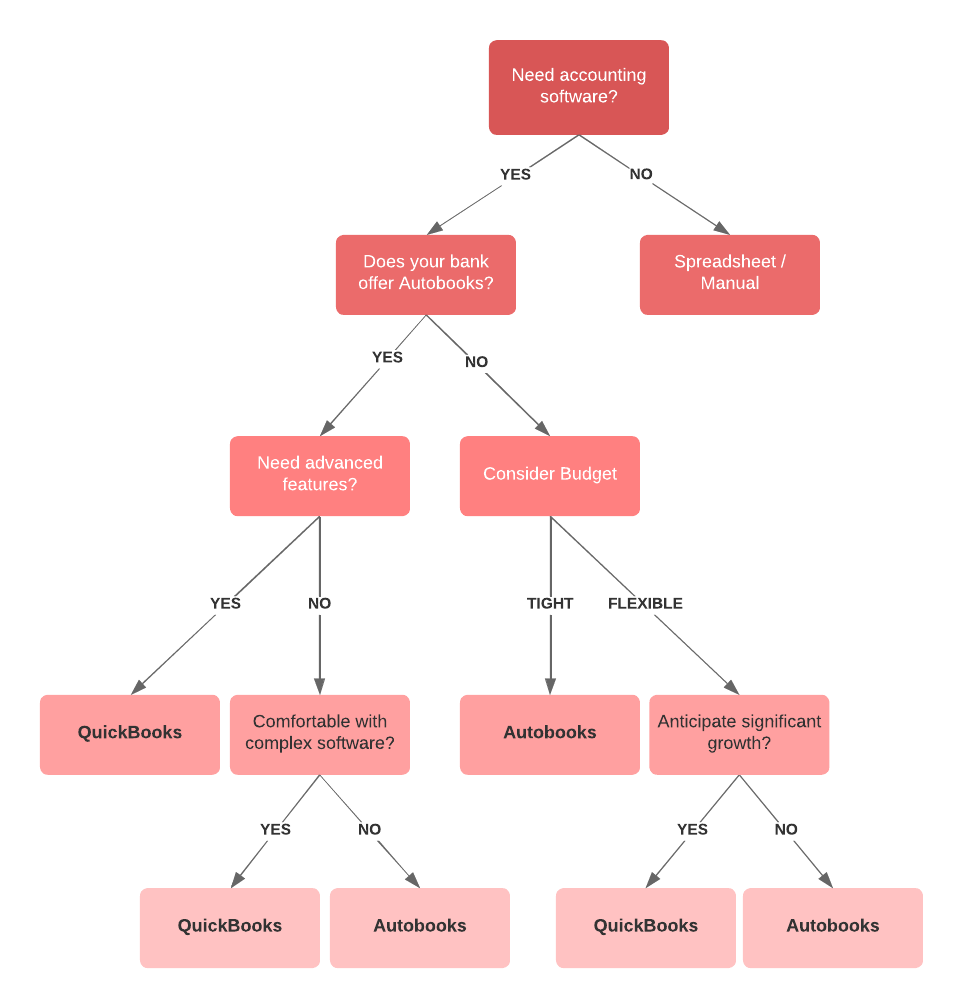

To determine which accounting platform is best, you will need to answer some fundamental questions about your business. Start by asking yourself if your business needs accounting software. What do you want to get out of your business? Are you comfortable using accounting software?

Generally speaking, if you are a micro or small business with limited growth plans, Autobooks will likely meet your small business accounting needs. Autobooks can integrate with your CS Bank Business checking account if you are a CS Bank customer. For larger businesses requiring more complex accounting, QuickBooks' scalability can grow with your business.

We've created a decision tree to provide a general guideline. Remember to consider your specific small business priorities when making the final decision.

.png)

Autobooks is designed with small businesses in mind.

CS Bank has partnered with small businesses throughout Northwest Arkansas and Southwest Missouri for over 110 years. We help small businesses grow with comprehensive small business banking services, including Merchant Card Services to help accept payments, Cash Management Services with ACH functionality to manage your cash flow, Business Checking options, and Business Credit Cards for everyday purchases. Are you looking to build your business's nest egg or set aside funds for upcoming expenses? Open a Business Savings Account or Commercial CD and earn interest on your cash reserves. Stop by one of our local branch locations today and let us help you with your small business banking needs.