Buying a home can be a lengthy process and feel overwhelming at times, but it’s also an exciting moment in your life. If you’re preparing to embark on the process of buying a home, CS Bank is here to help. We’ll break down the home buying process and what you can expect, especially if you’re looking for first time homebuyer tips.

Determine If You’re Ready to Buy a Home

The first question you must ask yourself before diving into buying a house is whether you’re ready for this big responsibility. Consider whether it’s cheaper for you to rent or buy in Arkansas or Missouri before you commit to searching for a house or looking into how to apply for a mortgage.

Think about whether you have enough money saved for a down payment and if you credit is in good standing—when it comes to homebuying tips, those are two of the most important to keep in mind.

You’ll also want to think about whether you have a stable work history and if you’re financially prepared for the expenses that come along with home ownership, not just the down payment. There are ongoing expenses that all new homeowners need to consider before taking the leap into home ownership.

Gather Your Financial Records

There are certain financial documents that you’ll need to have put together when you apply for your mortgage loan, even when you’re simply looking for preapproval. This is a vital part of the home buying process timeline, so you’ll want to gather those documents as early as possible so that things go smoother when you’re finally ready to make an offer.

Some of the documents that you’ll need to put together include:

- Current mortgage statements if you own a home

- Proof of identity like a drivers license or passport

- Recent paystubs

- Recent W2s or tax statements

- A copy of a recent bank statement

- List of your current debts

Get Preapproved

If you’re starting to think about how to start the home buying process, getting mortgage preapproval is an excellent first step to take before you even begin to look at properties. A preapproval letter is a document that a lender can provide you with that states the amount they’re willing to lend you for a home.

A preapproval letter is a great way to demonstrate to both sellers and their realtors that you’re serious about purchasing a home. If you’re up against several other offers on a property, having preapproval could put you at the top of the list for the seller to accept your offer. It can also save significant time when it comes to applying for your mortgage officially.

Find Your Home

Find the Best Time to Buy a Home

If you’re not in a rush to move, try to time your home buying process so that it works in your favor. Especially in times when inflation is high, it may be worth waiting to shop around for lower mortgage rates later. If you can shop during a buyers market, even better!

The market conditions aren’t in your control, though, so don’t put your plans on hold because of those outside situations if you want to move. Spring is a wonderful time for open houses, so if you’re looking at buying a house in Cassville or your first home in Northwest Arkansas, take in as many open houses at this time of year if you can.

It’s good to keep in mind that spring and summer are also the times of year where there’s highest competition among buyers, so looking at homes in the winter can be helpful if you’re trying to get a deal as sellers may be more willing to compromise.

Try to strike a balance by house hunting in late summer and early fall when competition might be lower but there are still a range of properties on the market. Develop a cadence that works for you and your realtor when it comes to viewing homes. Don’t overdo it and take some breaks. Know when you’ve looked at too many houses in one day!

Be Prepared to Search for a While

Finding the perfect home isn’t an easy task but it’s an essential part of the home buying process checklist! You likely have a list of wants and needs, but don’t try to limit yourself to a particular style of home or buying timeline.

Buying a home in northwest Arkansas or Missouri is a big decision and likely the biggest purchase you’ll ever make. House hunting can take several months when you’re looking for the right place but know that your dream home is out there.

Make an Offer

Once you’ve found the house you want to buy, it’s time to make an offer. Work with your realtor to determine how much to offer and look at comparable properties, along with the current market conditions. If demand is high and inventory low, you may need to make an offer above asking, but if there’s low demand and high inventory, you may be able to make a lower offer.

Always work with your relator to determine a price. They have plenty of experience and can help you decide on the best plan based on current market conditions. You’ll also want to list your contingencies with your offer, which are conditions that must be met or you have the right to walk away. These conditions are typically based on the appraisal and inspection.

Submit your offer with contingencies clearly noted and provide an earnest deposit when the offer is accepted. This is usually 1-3% of the sale price and shows that you have the money to pay for your new home.

Purchase Homeowners Insurance

Homeowners insurance is required by your mortgage lender whenever you purchase a home. If you have auto insurance or other types of personal insurance, speak to your provider to see if you can get a multi policy discount.

Complete the Official Mortgage Application

You can submit your application to your mortgage lender once you offer has been made, but the lender will need to see the results of the inspection and appraisal, along with proof of insurance, before issuing your finds. If you completed the mortgage preapproval step, this part of the process should be quite simple.

Get the House Inspected

Getting your new property inspected isn’t a legal requirement but it’s strongly recommended. This is done once the offer is accepted and the sale is contingent on a good inspection before completion.

You may want to renegotiate the price if the inspection shows multiple areas that need fixing, like a new roof or HVAC system. Either the current owners should fix these ahead of the closing date, or lower the sale price to give you room in your budget to address those issues.

Get the Home Appraised

An appraisal determines the current market value of the property. Mortgage lenders want to see that your house is appraised for at least the market value and what you’re paying for the home, as this suggests that they could get their loan money back if you foreclosed on the home.

If the house doesn’t appraise for the agreed upon sales price, talk to your lender or realtor about next steps. You won’t be able to get a mortgage for more than the appraised price, so the seller will need to come down on price or you’ll have to walk away if they won’t negotiate.

Complete the Title Search

A house title is a record of every person who has owned the property before the current sellers and notes if there are any liens on the house like a mortgage. If you’ve purchased the house, your mortgage will be listed as a lien.

This isn’t the same as a house deed—the deed is a legal document that’s used to transfer property ownership. The title is simply documentation on ownership and any debts currently against the home.

Close on Your Home

Once you’ve had the inspection, appraisal and title search completed, you’re ready to close on your new home! Your insurance and mortgage will be processed on closing day when you take ownership of the home, so bring all of your documentation and deposit, along with closing cost check to your closing location.

How Long Does the Home Buying Process Take

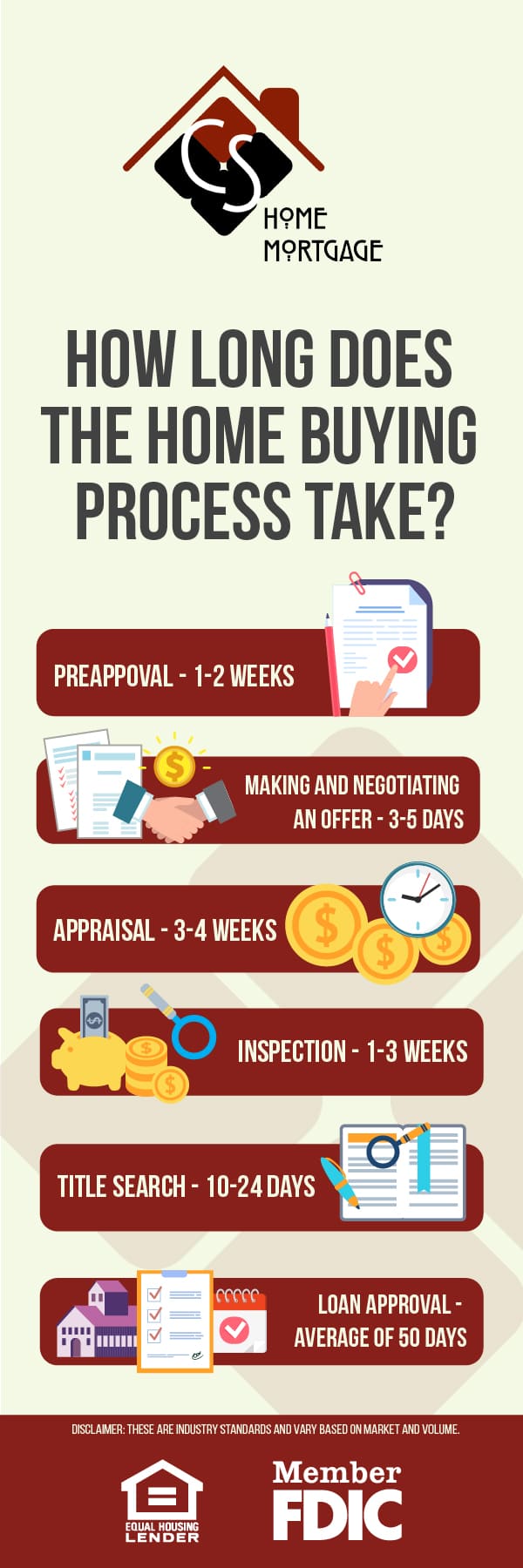

The homebuying process can vary based on many different factors. It can typically take anywhere from four weeks to six months, from the time you start searching until you close.

The majority of the process is likely the home search, which can take several months. If you’re in no rush, you might want to take longer to find the right home. Don’t hold yourself to a timeline and make sound, informed decisions about what property you want to buy.

The typical process can look like:

- Preappoval - 1-2 weeks

- Making and negotiating an offer - 3-5 days

- Appraisal – 3-4 weeks

- Inspection - 1-3 weeks

- Title search - 10-24 days

- Loan approval - average of 50 days

Start the Home Buying Process Today

Find your dream home and get approved with a CS Bank home mortgage. As a full-service mortgage lender, we can help you with all your home loan needs. We offer various types of mortgages so you can find the right one for you. Get preappoved today! Apply online or stop in at a branch to speak directly with a mortgage lender.